Resources

FAQ

Frequently Asked Questions

Project Overview and Governance

Why is UCF redesigning its budget allocation process?

This is a unique time in our country’s history and the continued development of our institution to meet the evolving needs of our community. To do so, we must commit to a collaborative, transparent and inclusive budget allocation process that is simple to understand, will help us plan for the future and invest in our strategic priorities, and reflect UCF’s core values, principles and goals.

UCF’s current budget process was built in a different era. Our process allocates funding based on the previous year’s budget, plus or minus a percentage. This approach is largely predictable, but it is difficult to adapt to changing circumstances or fund strategic priorities. Shifting to a more strategic, data-informed model can significantly improve fiscal stewardship, empower colleges and schools to grow program revenues, and encourage administration to operate more efficiently while providing improved services.

What are the project’s guiding principles?

Financial leaders across UCF were interviewed during the early stages of the project to better understand the budget model redesign considerations and help the institution clearly define key objectives. As a result of that process, a set of Guiding Principles were adopted to inform the budget model development process and communicate its key objectives.

The Guiding Principles may be found here.

Who is leading this effort?

The project’s Executive Sponsors are the Provost and Vice President for Academic Affairs and the Chief Financial Officer.

Appointed by and serving at the discretion of the President and Executive Sponsors, a Steering Committee comprised of university-wide leaders and other stakeholders was appointed in November 2019 to guide the process of identifying and recommending a new allocation model that best aligns with UCF’s strategic direction, and institutional culture and values. The Steering Committee was supported by a Project Team, as well as Huron Consulting Group members that were retained to help UCF assess the current state of budgeting and engage campus-wide stakeholders to develop the new model.

The Steering Committee members and information about the governance structure can be found here.

Has the Steering Committee completed its charge?

Yes. The Steering Committee completed its charge in May 2020 with a recommendation that UCF develop and implement an incentive-based budget model following a phased, multi-year approach. The budget model was approved by a unanimous vote in favor of the model by the academic Deans, approved by the President, and shared with the Board of Trustees in May.

What is the planned governance structure?

Establishing a governance structure with active representation from academic, self-supporting, and administrative stakeholders is necessary to effectively implement a new budget model and maintain a university-wide perspective that will ensure continuity and long-term success. UCF’s Executive Sponsors (Provost/CFO) are currently considering the appointment of a series of committees to support the implementation of the new model and to create a system of checks and balances, ensuring transparency of all budget decisions, policies, and processes throughout each budget cycle.

In the interim, regular discussions are taking place between the Executive Sponsors and Steering Committee Co-Chairs (Associate Vice President for Financial Affairs Kristie Harris and Dean Paul Jarley), who continue to be responsible for project progress throughout the parallel year and for ongoing communication and updates to the campus community. Additionally, the recently reconvened University Budget Committee (UBC) will be leveraged to make recommendations and play an active role with the new model.

Implementation Process and Timeline

What is the project timeline and expected outcome?

Transition to a new budget model can entail cultural shifts and requires time and resources to develop new processes, train administrators and staff, and respond to possible staffing changes due to increased responsibility or the need for greater financial expertise. Accordingly, industry experts recommend a multi-year approach for this transition.

To ensure successful and timely engagement, UCF is following a multi-year phased approach to understand the redesign considerations and provide ample opportunities for stakeholder input as we work towards a customized model built specifically to meet our needs. This will begin in fiscal year 2021 with a “hold-harmless” period of at least one year so that units can see the effects of changes without having to contend with sudden budget declines or windfalls driven by the new model.

More information about the project approach and timeline may be found here

What can we anticipate during the parallel year (FY 2021)?

The parallel year of a new budget model provides an additional year to build out helpful infrastructure, deploy ongoing trainings and educational outreach, and review another year of data to understand the potential implications of the new model. During this year, units will continue to engage with the University Budget Office to better understand the model, review the new annual budget timeline and processes, and understand the implications of the new model for future years. This period also allows the university to refine and tweak the model to adjust for unintended implications or outcomes.

Additionally, there will be a series of townhalls, training events, and web courses to actively educate, engage and obtain feedback from our UCF community.

Stay tuned to this website and campus announcements for information as events unfold.

Incentive Based Model

What is Incentive-Based Budgeting?

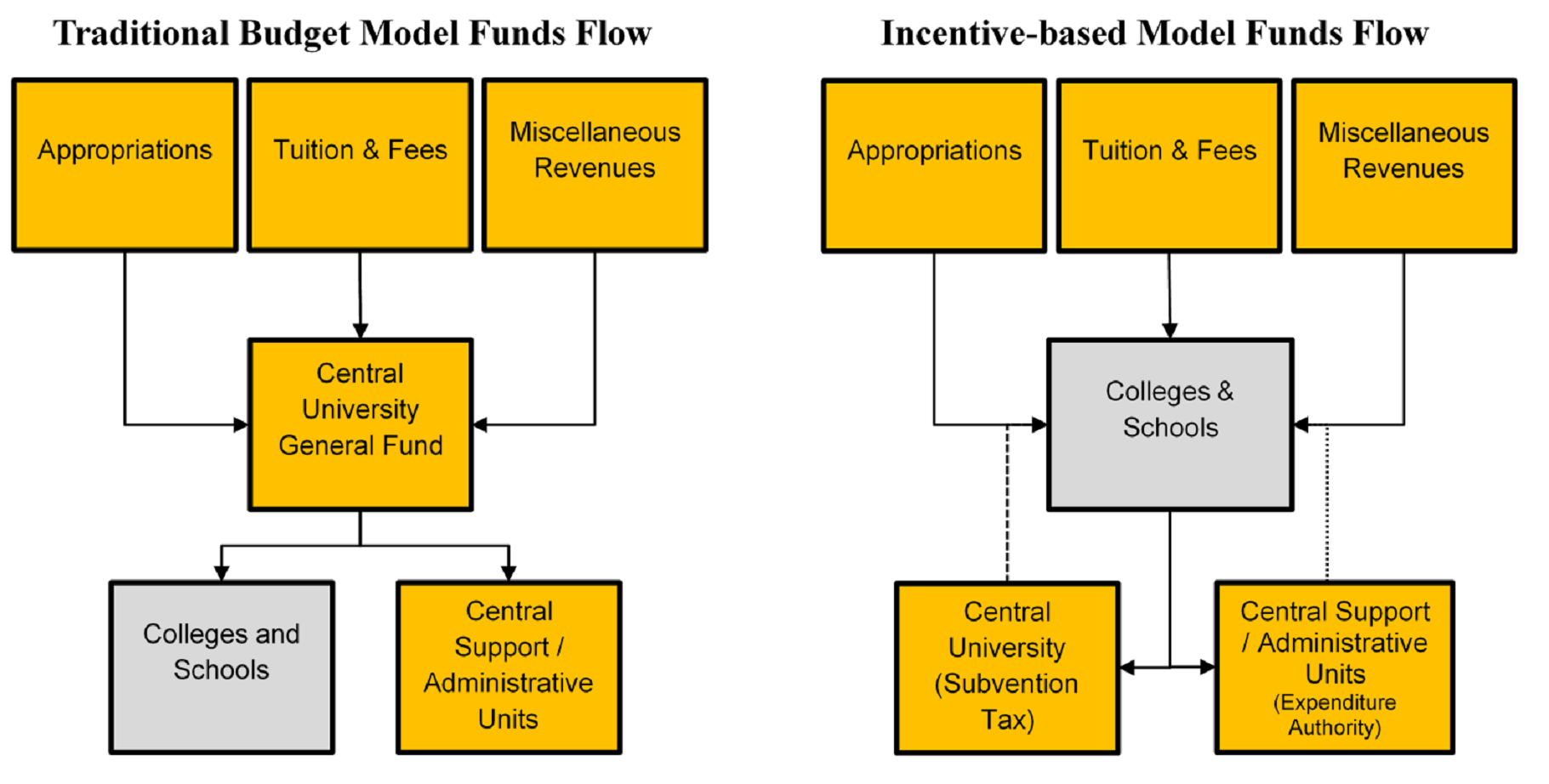

Incentive-based budgeting is a management philosophy designed to align budget allocations with university goals and objectives by decentralizing several components of budget authority. In an incentive-based budget model, a framework is created to directly allocate funding to the units generating the revenue, then charges are assessed to cover the unit’s share of centrally borne expenditures like administrative and common service and support.

How does the new budget model compare to our current budget system?

UCF’s current budget model is incremental. This means that revenues (tuition and fees plus state appropriations) are held centrally and distributed to the campus following a historical model of base budgets. The new model will remove the central hold and distribution of revenues as they are directly recognized in the units that earn them.

What other universities are undertaking or have completed similar budget model redesign initiatives?

Universities regularly look at their budget models to determine whether or not they are as effective. No two universities are alike and so too are no two budget models. Examples of some other institutions that have engaged in a similar process may be found here.

Who are UCF’s aspirational and peer institutions?

UCF’s peer aspirational and peer institutions may be found here.

Example of Funds Flow for Traditional Model vs. Incentive-Based

The goal is to delegate aspects of the operational authority to colleges, divisions, and other units, allowing them to align their goals with UCF’s strategic direction.

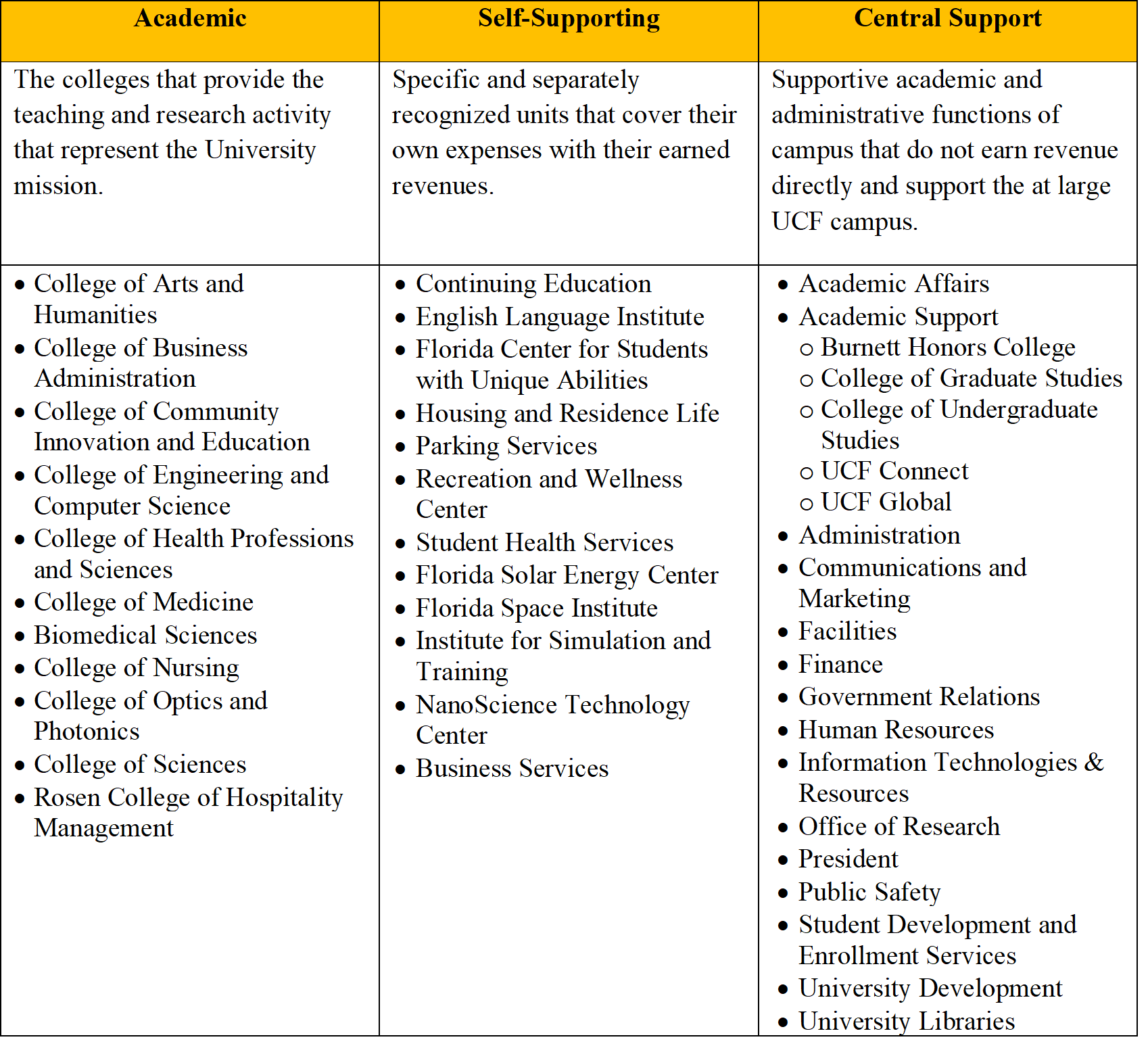

How are units classified?

What are allocated revenues and central support costs?

Allocated revenues are historically received and held centrally, before being given to campus units through their budget spending authority. The new model recognizes these revenues directly in the units that generate them, by allocating them largely based on teaching (SCH) and research. The allocated revenues include the university’s unrestricted state appropriations and tuition.

Central support costs are the net costs of the central units (e.g. HR, Finance, IT, etc.). The central units support UCF’s functions are considered a service to the academic and self-supporting units. The net costs of the central units are distributed to the academic and self-supporting units through a decided allocation metric that measures the units’ proportion of the shared service.

What revenues are allocated?

Tuition is allocated based on the instructional activity and student advising through student credit hours. For every student credit hour, the college who teaches the course receives 80% of the tuition received, while the college who owns the student’s major and academic support receives the other 20% of the tuition. The balance of tuition is intended to recognize the shared expense of supporting students regardless of where they may be taking classes and mirrors historical spend on instruction vs. academic support. Here are a few examples of how this works in practice for any College (example uses the College of Business and Colleges of Sciences):

- The College of Business teaches a student from the College of Sciences. The College of Business receives 80% of the net tuition for teaching the student but 20% of the net tuition goes to the College of Sciences for serving as the student’s home college

- A College of Business student takes a course in the College of Sciences. Sciences receives 80% of the net tuition for instructing the student and Business receives 20% of the net tuition for serving as the student’s home college.

- A College of Business student takes a course in the College of Business. The College of Business receives 100% of the net tuition revenue for this course as they are teaching their own student.

The state appropriation is allocated in three pools that recognize units for instructional effort (42.5%), student completion (42.5%), and research activity (15%). These pools were decided to incentive strategic growth of the academic units to continue to teach and complete students, while also encouraging research growth. This provides equal incentives for colleges to grow towards strategic goals, regardless of their context.

How are the central support function costs allocated to the operating units?

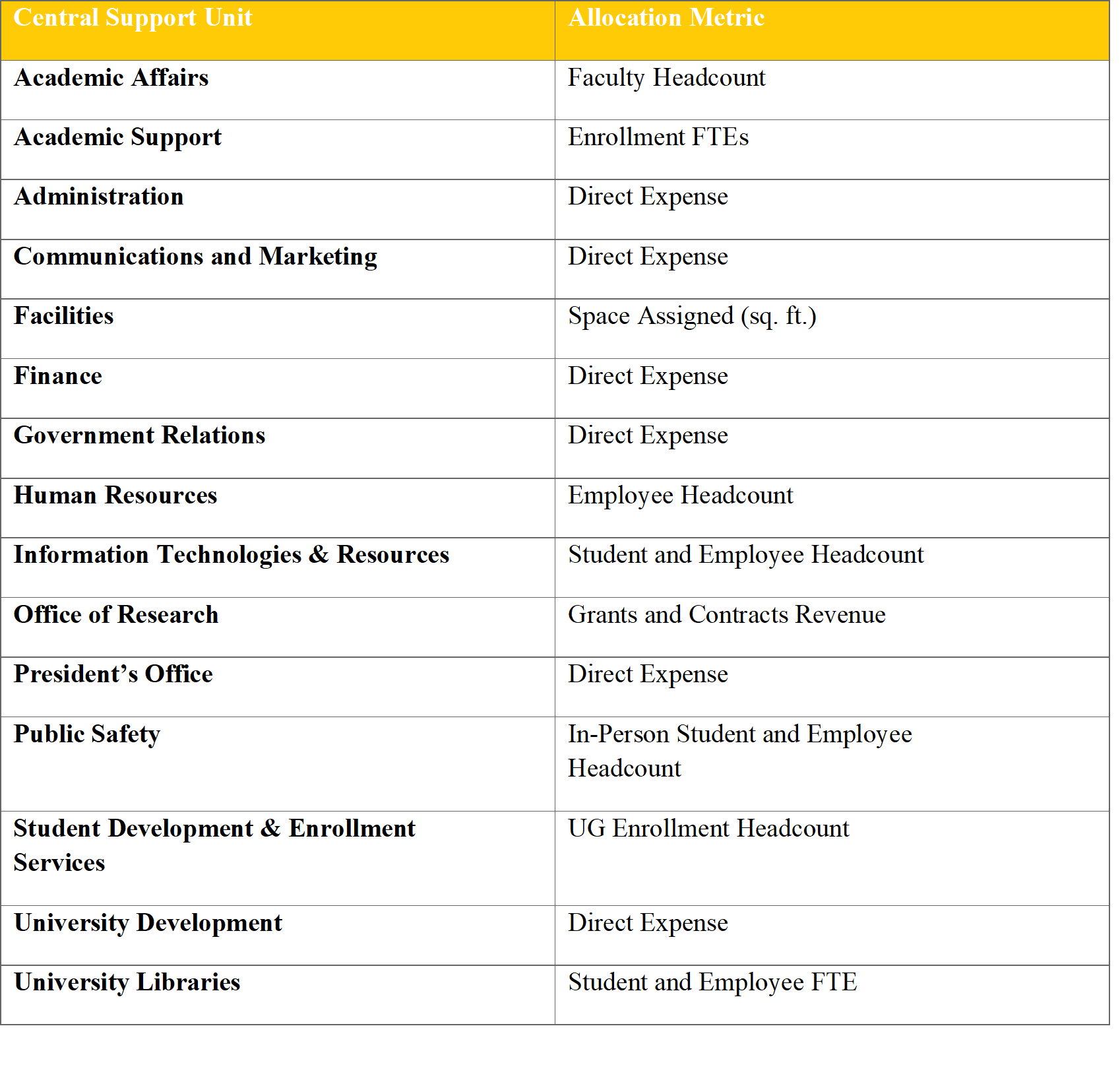

The central support units (CSUs) have their margin allocated to the operating units. Each identified central unit has an allocation metric that proportionally distributes the net cost of the central unit. These allocation metrics will provide a proxy measurement of how much of central support function the operating unit consumes.

For example, Academic Affairs uses faculty headcount as its allocation metric, a college that owns 10% of the university’s faculty will then be charged for 10% of the costs of Academic Affairs. The relation of the cost of the central unit and the driving allocation metric are purposely aligned and will not cause variability for changes in metrics. As colleges add more faculty, their proportion will increase but the needed administrative support of Academic Affairs will also increase, removing the “disincentive” for increasing a unit’s share of the metric.

The table below illustrates the identified central support units and the identified allocation metric. The allocation metrics are not intended to be precise in determining the allocation for each unit’s utilization of a service.

What is the participation fee and what is it used for?

In order to support the additional costs of the central support units, a central pool is created through a participation fee. The participation fee is a charge on unrestricted revenues of academic units that creates a pool of university investment. This pool is used for two purposes: to create a subvention pool to support the expenses of all revenue units and build a strategic investment pool to support additional activity at the direction of the President and his senior team.

Will this change the funding levels for any unit on campus?

The model will not directly create or remove funding from any unit. The model will serve as a tool that clearly identifies what activity occurred in past years to help inform budgeting decisions for future years.

How is the quality of data used to drive the model ensured?

UCF is embarking upon a new journey to get a new Enterprise Resource Planning (ERP) system to support finance, human resources (HR), and student services. While this effort will increase the institution’s access and ability to best leverage institutional data, current datasets and programs will be utilized in the interim.

Data sets will be maintained by the various campus owners and units. A combination of data provided by Institutional Knowledge Management (“IKM”) and Finance will be the central points of the model. Additional datasets will be included as necessary.

How does this model provide transparency to the university budget process?

Unlike our current model, the new budget model will provide a clear connection to costs within the university, including clearly illustrating the amount of money units are allocated for central support services (e.g. HR, Finance, IT, etc.) and the amount of money to support university subsidization and strategic funding.